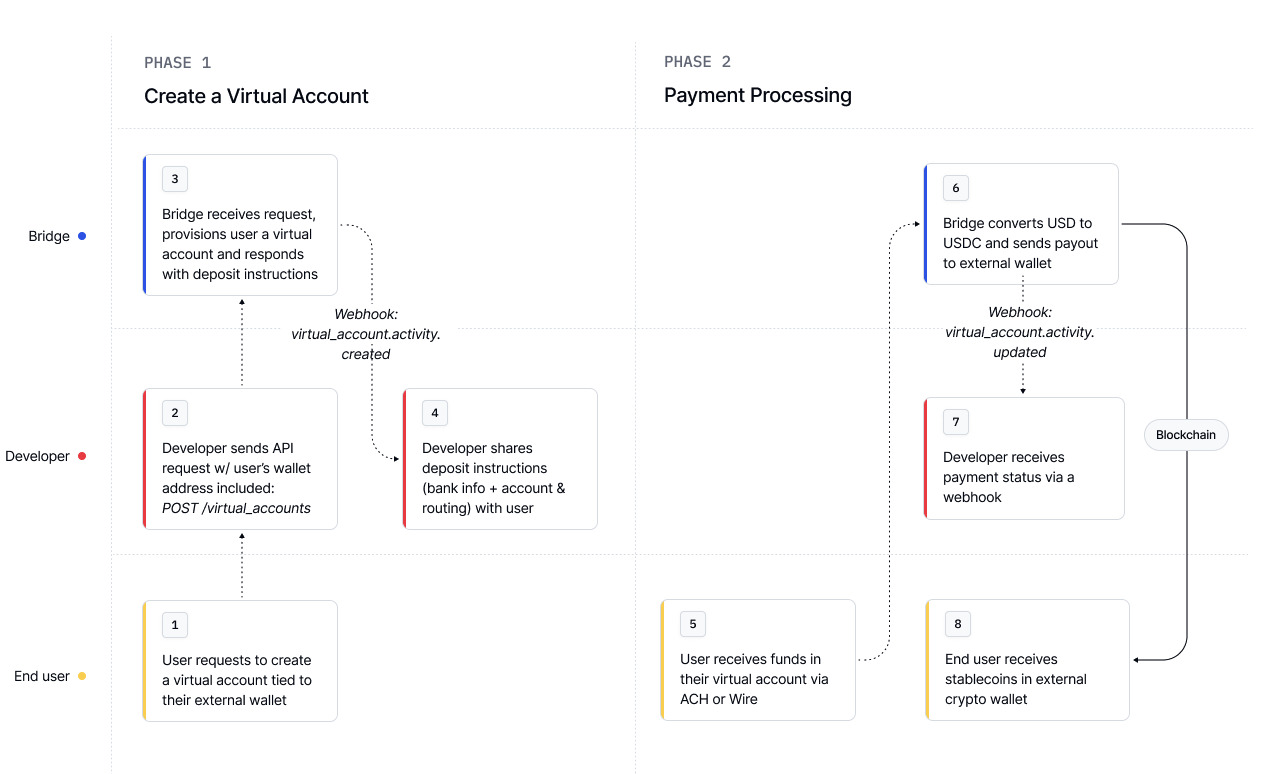

Onramp to stablecoins with virtual accounts

Virtual accounts are a powerful lego block to build delightful payment experiences.

Overview

Bridge virtual accounts are permanent, reusable fiat deposit addresses that convert incoming fiat into crypto and deliver it to your specified destination (e.g. a wallet address).

They support multiple currencies and provide customers with local deposit details like account numbers and routing codes. For example, a USD virtual account gives your customer a U.S. account and routing number for ACH or wire transfers.

Supported Payment Rails

- USD Virtual Accounts - U.S. bank account and routing numbers issued in your customer’s name.

- SEPA Virtual IBAN - Euro-denominated IBANs for accepting SEPA payments.

- MXN Virtual Accounts - CLABE account numbers for receiving SPEI (Mexico) payments.

Developers use virtual accounts to simplify global payments, custody stablecoins (e.g. USDB), and enable programmable flows. A common pattern: create a virtual account for a customer, route funds into a Bridge wallet, and earn yield.

👉 Note: Customers must be onboarded and KYC/KYB-approved before creating virtual accounts.

Step 1: Create a virtual account

Use the Virtual Accounts API to provision permanent fiat deposit addresses for your customers. You define the source currency for the account and configure the destination to specify where Bridge should deliver the converted funds.

Bridge handles the fiat-to-crypto conversion and sends the funds on-chain automatically.

API Example

API Request

curl --location --request POST 'https://api.bridge.xyz/v0/customers/<customer_id>/virtual_accounts' \

--header 'Content-Type: application/json' \

--header 'Api-Key: <Api-Key>' \

--header 'Idempotency-Key: <Unique Idempotency Key>' \

--data-raw '{

# The source object specifies a USD virtual account.

"source": {

"currency": "usd",

},

# The destination object instructs Bridge where to send the USD deposits to.

# Bridge will automatically handle converting and sending USD to the crypto destination.

"destination": {

"payment_rail": "ethereum",

"currency": "usdc",

"address": "0x3f5CE5FBFe3E9af3971dD833D26BA9b5C936f0bE"

},

# You can specifcy an optional developer fee to monetize on transactions.

"developer_fee_percent": "1.0" // 1%.

}'

curl --location --request POST 'https://api.bridge.xyz/v0/customers/<customer_id>/virtual_accounts' \

--header 'Content-Type: application/json' \

--header 'Api-Key: <Api-Key>' \

--header 'Idempotency-Key: <Unique Idempotency Key>' \

--data-raw '{

# The source object specifies a SEPA virtual IBAN.

"source": {

"currency": "eur",

},

# The destination object instructs Bridge where to send the EURO deposits to.

# Bridge will automatically handle converting and sending EURO to the crypto destination.

"destination": {

"payment_rail": "ethereum",

"currency": "usdc",

"address": "0x3f5CE5FBFe3E9af3971dD833D26BA9b5C936f0bE"

},

# You can specifcy an optional developer fee to monetize on transactions.

"developer_fee_percent": "1.0" // 1%.

}'

curl --location --request POST 'https://api.bridge.xyz/v0/customers/<customer_id>/virtual_accounts' \

--header 'Content-Type: application/json' \

--header 'Api-Key: <Api-Key>' \

--header 'Idempotency-Key: <Unique Idempotency Key>' \

--data-raw '{

# The source object specifies a MXN virtual account.

"source": {

"currency": "mxn",

},

# The destination object instructs Bridge where to send the MXN deposits to.

# Bridge will automatically handle converting and sending MXN to the crypto destination.

"destination": {

"payment_rail": "ethereum",

"currency": "usdc",

"address": "0x3f5CE5FBFe3E9af3971dD833D26BA9b5C936f0bE"

},

# You can specifcy an optional developer fee to monetize on transactions.

"developer_fee_percent": "1.0" // 1%.

}'

API Response

{

"id": "1a400dae-f7fc-4f75-8105-212a14d4132d",

"status": "activated",

"developer_fee_percent": "1.0",

"customer_id": "23c2d200-4c00-4c5a-b31a-00d035d7e0ae",

"created_at": "2025-07-04T22:10:34.564Z",

"source_deposit_instructions": {

"currency": "usd",

"bank_name": "Lead Bank",

"bank_address": "1801 Main St., Kansas City, MO 64108",

"bank_routing_number": "101019644",

"bank_account_number": "215268120000",

"bank_beneficiary_name": "Ada Lovelace",

"bank_beneficiary_address": "923 Folsom Street, 302, San Francisco, California 941070000, US",

"payment_rail": "ach_push",

"payment_rails": [

"ach_push",

"wire"

]

},

"destination": {

"currency": "usdc",

"payment_rail": "ethereum",

"address": "0x3f5ce5fbfe3e9af3971dd833d26ba9b5c936f0be"

}

}

{

"id": "393c6358-4c19-4cb7-bbfa-d4a56be58309",

"status": "activated",

"developer_fee_percent": "1.0",

"customer_id": "23c2d200-4c00-4c5a-b31a-00d035d7e0ae",

"created_at": "2025-07-04T22:07:18.701Z",

"source_deposit_instructions": {

"currency": "eur",

"iban": "IE90MODR14035307970528",

"bic": "MODRIE00XXX",

"account_holder_name": "Bridge Building Sp.z.o.o.",

"bank_name": "Modulr Finance, Ireland Branch",

"bank_address": "Floor 6, 2 Grand Canal Square, Dublin, Ireland",

"payment_rail": "sepa",

"payment_rails": [

"sepa"

]

},

"destination": {

"currency": "usdc",

"payment_rail": "ethereum",

"address": "0x3f5ce5fbfe3e9af3971dd833d26ba9b5c936f0be"

}

}

{

"id": "35334433-dcee-48e8-bdc8-90171234ad00",

"status": "activated",

"developer_fee_percent": "1.0",

"customer_id": "23c2d200-4c00-4c5a-b31a-00d035d7e0ae",

"created_at": "2025-07-04T22:13:29.481Z",

"source_deposit_instructions": {

"currency": "mxn",

"clabe": "568980546701071234",

"account_holder_name": "Ada Lovelace",

"payment_rails": [

"spei"

]

},

"destination": {

"currency": "usdc",

"payment_rail": "ethereum",

"address": "0x3f5ce5fbfe3e9af3971dd833d26ba9b5c936f0be"

}

}

Sharing Deposit Instructions

Once a Virtual Account is created, use the source_deposit_instructions object in the response to share the fiat deposit details with your customer. Funds sent to those details will be automatically converted and delivered to the crypto destination you specified.

Step 2: Monitoring virtual account events

Once a Virtual Account is created, your customer can start receiving fiat payments using the provided deposit instructions.

Bridge automatically tracks the full lifecycle of each deposit—from the moment funds are received to the point they are delivered on-chain. Each event in this lifecycle is represented by a VirtualAccountEvent.

Event Creation and Tracking

Whenever a deposit is received, Bridge generates a VirtualAccountEvent with a unique id. You can:

- Fetch historical events using the Virtual Account Activity API.

- Receive real-time webhook notifications when:

- A new deposit is received.

- The status of an event changes (e.g. funds delivered, refund issued).

Each VirtualAccountEvent includes detailed information about the deposit, source, status, and destination.

Virtual account event types

Below are the different types of virtual account events you may receive. You can identify the type of each event by checking the type field in the virtual account event object.

Payment Lifecycle

| Type | Description |

|---|---|

funds_received | Bridge received funds via ACH or wire. |

payment_submitted | Bridge submitted the crypto payment. |

payment_processed | Payment confirmed on-chain. Final state. |

funds_scheduled | (ACH only) Incoming funds are in transit with estimated arrival date. |

in_review | Transaction is under manual review. |

refunded | Funds could not be delivered and were refunded to the sender. |

Other

| Type | Description |

|---|---|

account_update | Virtual Account was updated (e.g. new destination address). |

deactivation | Virtual Account was deactivated. |

reactivation | Virtual Account was reactivated. |

microdeposit | Microdeposit verification detected. Funds are never onramped. |

All transaction-triggered events include a

deposit_idfield. This id is unique for each transaction that Bridge receives through this Virtual Account and can be used to link separate events to the same source transaction.

To see the full breakdown of VirtualAccountEvents and their payloads, refer Virtual Accounts.

Fetching virtual account activity

API Request

curl --location 'https://api.bridge.xyz/v0/customers/<customer_id>/virtual_accounts/<virtual_account_id>/history' \

--header 'Accept: application/json' \

--header 'Api-Key: <api-key>'

API Response

{

"count": 10, // Total number of events returned

"data": [

{

"id": "3686be0e-468c-e3ad-1dcd-b4a41b8b7632", // Unique ID of the event

"type": "payment_processed", // Event type: payment_processed means funds were delivered on chain

"currency": "usd", // Event source currency

"created_at": "2025-07-01T12:00:00Z", // Timestamp when the payment was processed.

"customer_id": "84325ad9-1c8f-5794-3738-373b980d466f",

"virtual_account_id": "4707fbec-f5a0-39d1-55d5-83fa18e1e49f",

"amount": "1500.0", // Deposited amount

"developer_fee_amount": "0.0", // Amount held for developer fees

"exchange_fee_amount": "0.0", // Exchange fees

"subtotal_amount": "1500.0", // Source amount after subtracting dev and exchange fees

"gas_fee": "0.0", // On-chain gas fee charged when sending crypto

"deposit_id": "ce898006-6347-f8b5-4e52-45185ba66e65", // ID of the deposit associated with this event

"source": {

"payment_rail": "ach_push", // Rail the funds arrived on (e.g., ach_push, wire)

"description": "Mock ACH Description 00", // Free-text description from the bank

"sender_name": "Sender 00", // Name of the sender provided by their bank

"sender_bank_routing_number": "00000000", // Sender's bank routing number

"trace_number": "000000000000000" // ACH trace number

},

"destination_tx_hash": "0xabcdabcdabcdabcdabcdabcdabcdabcdabcdabcdabcdabcdabcdabcdabcdabcd0", // Blockchain tx hash

// we include a receipt object to share transaction details with your customer

"receipt": {

"initial_amount": "1500.0", // Amount received before fees

"developer_fee": "0.0",

"exchange_fee": "0.0",

"subtotal_amount": "1500.0",

"url": "https://dashboard.bridge.xyz/transaction/mock_tx_0/receipt/mock_receipt_0",

"gas_fee": "0.0",

"final_amount": "1500.0", // final amount after subtracting any gas fees

"destination_tx_hash": "0xabcdabcdabcdabcdabcdabcdabcdabcdabcdabcdabcdabcdabcdabcdabcdabcd0"

}

},

{

"id": "e8d43469-efcc-90e2-c64d-6c50c8e8912f",

"type": "funds_received", // Event indicating fiat funds have arrived

"currency": "usdc",

"created_at": "2025-07-02T12:00:00Z",

"customer_id": "5b6575f9-d3e4-79d1-ed7d-62c02ab14af3",

"virtual_account_id": "9c132b3f-476e-5eaf-4e17-fed4b06dd93e",

"amount": "1500.0",

"developer_fee_amount": "0.0",

"exchange_fee_amount": "0.0",

"subtotal_amount": "1500.0",

"gas_fee": "0.0",

"deposit_id": "3f8dc835-c994-67f1-3221-77b1060ed2f7",

"source": {

"payment_rail": "ach_push",

"description": "Mock ACH Description 01",

"sender_name": "Sender 01",

"sender_bank_routing_number": "00000001",

"trace_number": "000000000000001"

}

}

// ... additional records omitted for brevity ...

]

}

Learn More

Refer Virtual Accounts for more detailed documentation.

Updated about 4 hours ago